I have been watching the latest fashion accessory in close detail.

No, it is not a cute hand bag or the latest sandal.

It is the phenomenon that took us into its magic spell:

Buy Now and Pay Later.

There are a few versions but AfterPay and ZipPay are the most common on retailers websites.

I wanted to shine a light on all aspects of this type of credit, hence the suitable article title: the good, the bad and the ugly.

First things first. What is it?

Buy Now Pay Later – How it Works

Recently I looked after a personal shopping client and upon paying she was offered AfterPay. She had no idea what it was and how it worked. She grew up in the era of lay buy, where you saved up and paid off your item before you could enjoy it.

Buy Now will allow you to enjoy the item now and pay for it later. Essentially using a line of credit that AfterPay and ZipPay extend to you.

You apply for this online first and open your account. For research purposed I have done this.

AfterPay

AfterPay allows you to pay for your item in 4 instalments, every 2 weeks. With the first payment upfront before you get the item.

If you meet your instalments you will not pay anything for this service.

You have to be over 18 and holder of a credit or debit card they can charge the instalments to.

The AfterPay website is like a giant online shopping mall/search engine showing all participating retailers.

AfterPay Late Fees

If you do fall behind in your payments, you will be charged late fees. An initial $10 late fee, and a further $7 if the payment remains unpaid 7 days after the due date.

For each purchase below $40, a maximum of one $10 late fee may be applied. (That is a 25% interest charge).

For each purchase of $40 or above, the total of the late fees that may be applied are capped at 25% of the original order value or $68, whichever is less.

AfterPay Sign Up Process

You sign up online or via their App in less than 30 seconds, no questions asked.

No connection required to bank or PayPal upon signing up.

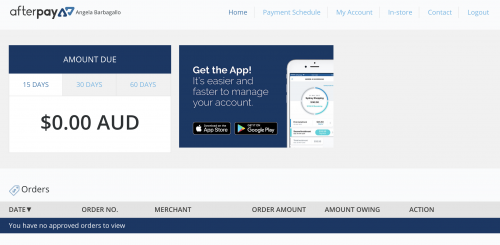

The back end looks like this.

ZipPay

ZipPay opens the opportunity for you to decide when you want to pay for the item as long as you pay off $40 before the end of the month. It is for all purchases under $1000. For purchases over $1000 it is ZipMoney you would use.

I noticed a disclaimer on how they can afford to give you this line of credit:

“We charge the store a small fee on each transaction, just like credit cards do. That fee then helps us to provide you interest free terms on every purchase. It’s that easy!”

Minimum age is 18.

ZipPay Late Fees

You need to repay a minimum of $40 per month. There is a fee of $6 per month if your balance is not $0.

Upon signing up I notice another fee I had not yet seen on the ZipPay website.

“$5 added to your Account when any Minimum Repayment Amount is not paid within 21 days after your Due Date.”

Sign Up Process

Sign up process is easy but there is a connection required to your bank or PayPal upon signing up. And ZipPay requests a credit card or debit card number before sign up is complete.

When the credit card details are entered some check is done before the site tells me I am approved and sends me to a contract page to agree to.

At this point I decided to back out of the sign up process.

Within 45 minutes I received a reminder text and email to encourage me to finish the process. They really want my business.

ASIC’s Review

In doing research for this topic I wanted to get a 360 view of what this Buy Now Pay Later means for retailers, your credit rating and consumers.

There is no doubt that this is phenomenon has taken credit loving Australia by storm. A few weeks ago ASIC presented its first review and here were some of the findings:

The Good

What is good about Buy Now Pay Later is that it has pumped an incredible amount of extra revenue into our economy. I requested feedback from retailer and consumers, there was a flood of excited retailers claiming incredible growth in revenue.

Sarah Walkerden from One Stop Horse commented:

“In the 12 months we have had AfterPay – we have seen a huge increase in orders and turnover. In comparison to this time last year, our yearly turnover has increased by 65% – and a lot of that can be attributed to AfterPay and the convenience it offers. Roughly around 85% of our orders for the moment come through customers using AfterPay.

We have only had ZipPay for around a month or so – but have already had a fair few people purchasing with it – so it will be interesting to see how this goes over time.”

A comment from Animal Emergency Service opened my eyes that Buy Now Pay Later is also increasingly used for heartbreaking emergency payments needed by pet owners to save their much loved animals.

“We generally see an increase in finance applications following the Easter and Christmas periods as pet owners have already exhausted savings on holidays, presents and entertainment. We know that without these finance solutions it would leave pet owners with the heart-wrenching decision to elect less than ideal care or euthanasia, even when the condition is completely treatable.”

The Bad

In my research, I also spoke to a few financial professionals on what the consequences could be on your credit rating.

Boris Biskupic from eFiancial mentioned a few tips if you are thinking of applying for a loan:

“Credit accessors view Buy Now Pay Later as poor character for impulse buying. When they see credit cards maxed out, personal loans and then Afterpay, right or wrong, it is viewed as the poor behaviour of financial management.

Regardless of your life stage, if you are looking to apply for a home loan, car loan or personal loan, try to avoid to Buy Now Pay Later and have all outstanding payments cleared 3 months prior to the application. It will improve your chances of getting approved for a loan.

Try and use it for meaningful purchases, like home furnishings or essential items as opposed to discretionary and luxury items.”

I believe that for very action there will be a consequence and this pretty, fun, easy looking Buy Now Pay Later is yet to show us what the long term effects will be for this country. Let’s not forget that Australia is already in the top 5 of highest personal debt per person.

And this comment from Ross Marais leads me into The Ugly.

“When you have a whole generation of younger people using these services from a young age, it creates a habit that you never have to save money to buy something you want or need. This has everlasting effects later on in life.”

The Ugly

The younger generation is conditioned with Buy Now Pay Later with incredible marketing. As part of my job, I subscribe to lots of newsletters and AfterPay or ZipPay are often used as an encouragement to purchase.

All platforms come with a snazzy apps so you do have an overview of your spending and if you know what your incoming money is you can make the payments. But what if you have overspent? With this noisy marketing, view sample below, it is almost the norm to buy like this and easy to be tempted.

I find it increasingly hard to get my head around why you would not simply spend what you have right now. Call me old fashioned but I like the thrill of saving up for somethings. Like all things retro I am waiting to see a comeback of this phenomenon.

There is a certain egotistical pleasure about getting something you know you can’t afford in this moment. It can feel like a drug when you do press “place order”. A release. You are left with the “clean up”, making sure you can make your repayments on top of all stresses of life. And who likes cleaning up after you have just had a big splurge?

Raising The Next Generation

A mother of 2 kids under 12, I am making damn sure that I educate them on all things Finance and I instil the power of saving for something they want. No instant gratification, more no than yes and working for your money. They receive weekly pocket money if they finish their jobs and they can increase their weekly earnings by doing additional jobs that make life easier for me.

I recommend Scott Pape’s Barefoot Investor’s book for families as a healthy start point to teach your kids about money. A solid back bone to help them navigate the slippery slope of life.

As a family we don’t have a credit card, we splurge on things we save for and think twice before we buy. And when we do, we pay in full, with money we have in the bank.

Your Comments

Would love to hear your comments. The good, the bad and the ugly. No judgement from me as “each to their own”.

Leave a Reply